- Ecn forex broker

- Best forex

- Top broker forex india

- Regulated forex broker india

- Top rated forex broker

- Top 3 best forex brokers

- Best app for forex trading in india

- Top forex broker in world

- Forex broker reviews

- Forex broker volume

- Top 10 forex brokers in india

- Free credit forex broker

- Top forex broker

- Best forex application

- Best forex broker for indices

- Forex trading in india

- Best forex and crypto brokers

- Best paypal forex broker

- How to start forex trading

- Is forex trading legal in india

- Forex

- Top forex brokers

- Best forex broker for day trading

- Forex brokers in india

- Forex trading profit per day

- Forex trading us broker

- How much can be made from forex trading

- Forex for you login

- Rbi ban forex trading app list

- Forex broker

- Types of brokers in forex

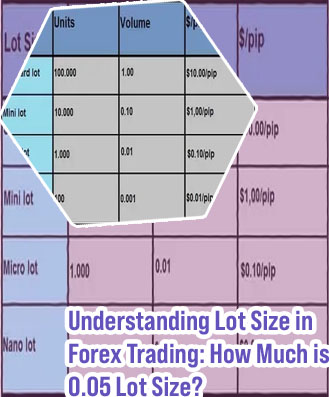

What is lot in trading forex

Understanding the concept of a standard lot in forex trading is crucial for beginners looking to enter the market. It is important to grasp the significance and implications of trading standard lots to make informed decisions and manage risk effectively. The following articles provide detailed insights into what a standard lot is, how it works, and its role in the forex market.

Understanding the concept of a standard lot in forex trading is essential for anyone looking to enter the forex market. A standard lot represents 100,000 units of the base currency in a currency pair, which is a significant amount for most individual traders. To help clarify this concept further, here are three articles that delve into the definition, significance, and practical implications of a standard lot in forex trading.

Demystifying the Standard Lot in Forex Trading

Forex trading can be a lucrative venture for those who understand the intricacies of the market. One important concept that traders must grasp is the standard lot. A standard lot in Forex trading refers to a unit of 100,000 units of the base currency. This may seem daunting for beginners, but with the right knowledge and strategy, trading standard lots can be manageable and profitable.

Here are some key points to demystify the standard lot in Forex trading:

-

Risk Management: Trading standard lots can involve significant risks due to the large position size. It is crucial for traders to have a solid risk management plan in place to protect their capital.

-

Leverage: The use of leverage in Forex trading allows traders to control larger positions with a smaller amount of capital. However, trading standard lots with high leverage can amplify both profits and losses, so it is important to use leverage wisely.

-

Position Sizing: Calculating the appropriate position size based on account size, risk tolerance, and stop loss levels is essential when trading standard lots. Traders should avoid overleveraging and risking more than they can afford to lose.

-

Profit Potential: While trading standard lots may require a larger initial investment, the profit potential can also be higher compared to trading smaller lot sizes

The Importance of Standard Lots in Forex Trading

In the world of forex trading, standard lots play a crucial role in determining the size of a trade. A standard lot in forex trading represents 100,000 units of the base currency. This standardized lot size allows traders to easily calculate their position sizes and manage their risk effectively.

For traders in India, understanding the importance of standard lots is essential for successful trading in the forex market. By trading in standard lots, Indian traders can easily compare different currency pairs and analyze their potential profits and losses. Additionally, trading in standard lots allows traders to take advantage of leverage offered by forex brokers, amplifying their trading capital and potential profits.

When trading forex, it is important for Indian traders to carefully consider their lot size based on their risk tolerance, trading strategy, and account size. By using standard lots, traders can better manage their risk and avoid overleveraging their accounts. It is also important for traders to stay informed about market conditions, economic indicators, and geopolitical events that can impact currency prices.

In conclusion, the importance of standard lots in forex trading cannot be overstated, especially for traders in India. By understanding and utilizing standard lots effectively, Indian traders can enhance their trading performance and increase their chances of success in the forex market.

Recommendations:

- Consider the impact

Navigating the Forex Market: How Standard Lots Impact Your Trades

The Forex market is a vast and dynamic financial market where currencies are traded. In this market, traders use different lot sizes to place their trades, with standard lots being one of the most commonly used. A standard lot in Forex trading is equivalent to 100,000 units of the base currency. Understanding how standard lots impact your trades is crucial for success in the Forex market.

One key aspect of standard lots is their impact on leverage. When trading with standard lots, traders can utilize leverage to amplify their trading positions. For example, with a standard lot size of 100,000 units and a leverage ratio of 1:100, a trader only needs to put up $1,000 as margin to control a position worth $100,000. This allows traders to potentially earn higher profits, but also exposes them to higher risks.

Another important factor to consider when trading standard lots is the impact on position sizing. With standard lots, each pip movement in the market results in a larger profit or loss compared to trading with smaller lot sizes. Therefore, traders need to carefully manage their risk and position sizes when trading standard lots to avoid significant losses.

In conclusion, understanding how standard lots impact your trades is essential for navigating the Forex market successfully. By carefully managing leverage and position sizing,